Everyone dreams of retiring early — some dream of freedom, others dream of opportunity. That’s why you’ll find so many courses online promising early retirement planning.

But before you dream, you need to wake up to reality — your early retirement can only happen when you earn more than you spend.

In the Sharan Hegde Retire Early Masterclass, Sharan focuses on helping you break free from your old money mindset, learn how to allocate your money across different investment assets, and secure yourself with the right insurance.

About Sharan Hegde

Sharan Hegde began his career as a finance influencer, teaching personal finance on his YouTube channel (Finance with Sharan). He later founded The 1% Club, a platform where he offers masterclasses and courses on investing, money management, and building wealth. He holds a Bachelor’s degree in Mechanical Engineering.

About Sharan Hegde Retire Early Masterclass

| Details | Information |

| 💰 Masterclass Fee | 249+GST |

| 🖥️ Platform | Zoom |

| ⏰ Duration | 2+ hours |

Who Should Join This Retire Early Masterclass? 👨💼

This masterclass is ideal for beginners and young professionals looking to gain financial clarity, learn investment basics, and take the first step toward financial independence.

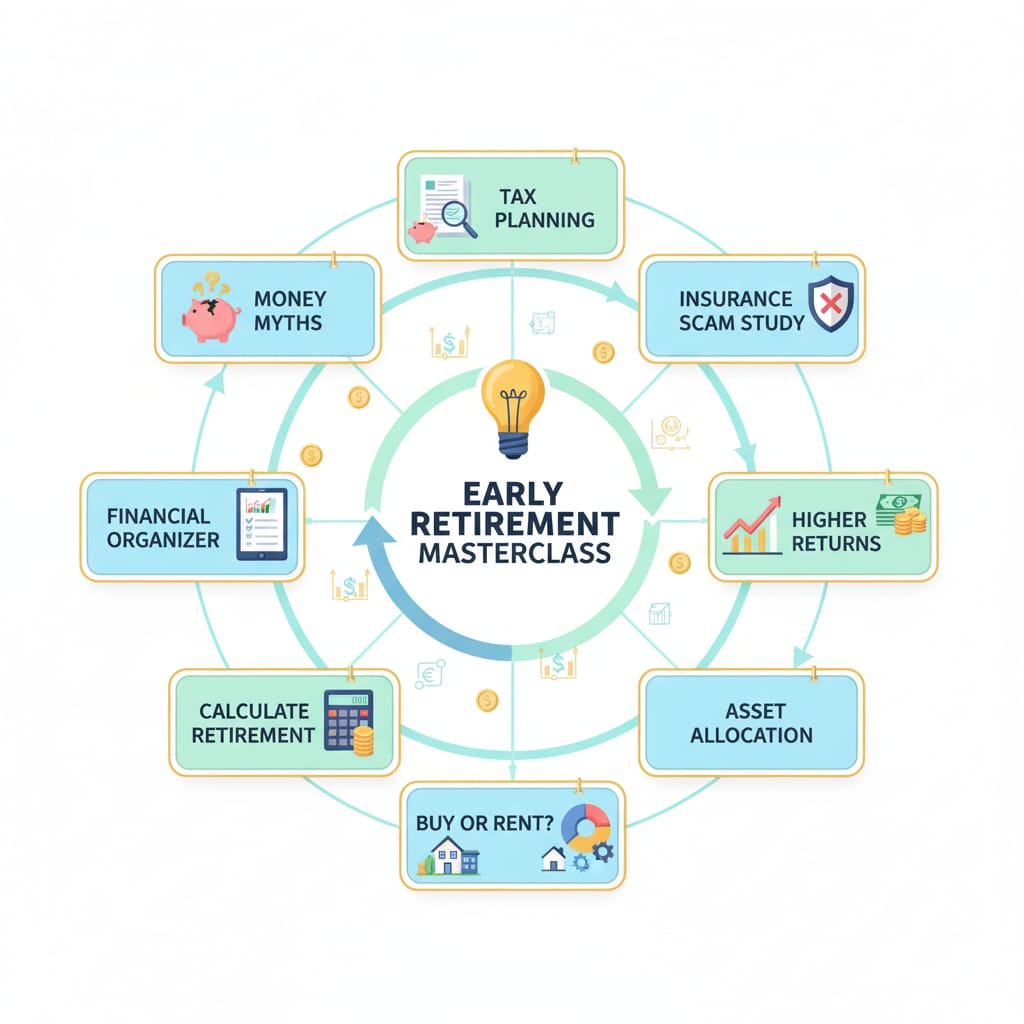

What’s Covered in the Sharan Hegde Retire Early Masterclass 📝

| 1. Money Myths Sharan breaks common money myths and discusses why traditional ways of investing no longer work in today’s financial world. |

| 2. Financial Organizer Walkthrough He explains how to use a simple Excel tool that helps you organize your finances and track expenses more effectively. |

| 3. Calculating Your Retirement Money Learn how to calculate your retirement corpus using an Excel tool so you can plan your future income and lifestyle confidently. |

| 4. When Should You Buy a Home? Sharan discusses the classic “rent vs. buy” debate and explains when buying a home actually makes financial sense. |

| 5. Asset Allocation He teaches how to strategically divide your money across equity, debt, gold, U.S. equity, and real estate based on your risk level and goals. |

| 6. Investing in Mutual Funds, Gold, and U.S. Stocks Understand where and how to invest your money smartly across different asset classes for better diversification. |

| 7. How to Get Higher Returns Sharan shares strategies to maximize returns and make your investments work harder for you. |

| 8. Financial Goals Learn how to plan your finances by setting clear short-term, medium-term, and long-term goals. |

| 9. Insurance Scam Case Study He takes a real example of an insurance platform to show how people often overpay for insurance. |

| 10. Tax Planning Smart ways to save more of your income through efficient tax planning. |

My Experience with Sharan Hegde’s Retire Early Masterclass

- The Retire Early Masterclass is focused on improving financial literacy among individuals.

- In this masterclass, Sharan Hegde talks about developing the right money mindset, allocating your money wisely, securing your finances through insurance, and planning your retirement using an Excel tool.

- He talks about money myths, such as buying a home vs. renting, and the misconception that company health insurance is enough.

- How to calculate your retirement corpus by understanding your monthly expenses and retirement age.

- It explains how to earn extra by investing your money in other assets where risk is higher but the return is increased, and explains it through comparisons.

- How to pay lower taxes and save more.

- However, if you already know about the topics discussed in the masterclass, it might feel more like a revision rather than a completely new learning experience. But after this masterclass, you do get the option to explore more advanced-level programs.

Overall, this Retire Early Masterclass is especially useful for beginners, as it provides clarity on key financial concepts. Sharan teaches through practical examples — making it easier for beginners or those who feel confused about financial planning to learn effectively.

Pros & Cons

| ✅Pros: | ⚠️Cons: |

| Clear and beginner-friendly | Content is widely available on the internet |

| Practical use of Excel tools for demonstrations | If you’re already at an intermediate or advanced level, you might find the masterclass more of a refresher than a new learning experience |

| Comes with a money-back guarantee |

FAQs – Retire Early Masterclass by Sharan Hegde

What is the Retire Early Masterclass by Sharan Hegde?

It’s a 2-hour online session where Sharan covers the fundamentals of personal finance and how plan your retirement.

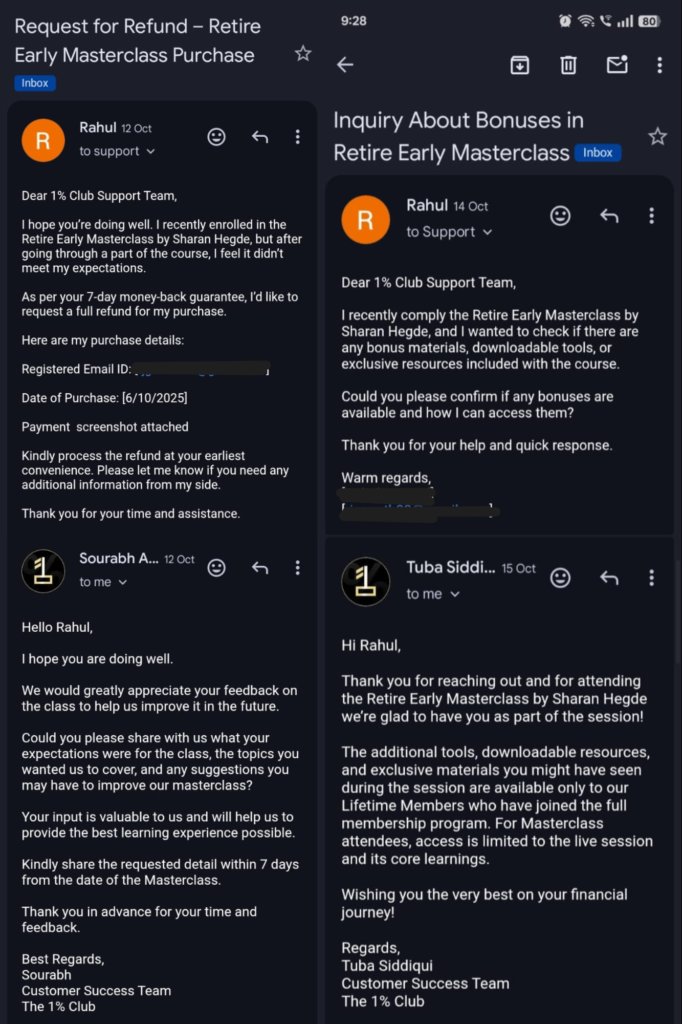

What about the refund policy or guarantee?

You get a 7-day refund option from the date of purchase, subject to certain conditions.

For support, you can contact: support@onepercentclub.io

Where will the masterclass be held?

The masterclass is conducted online via Zoom.

Who is this masterclass for?

This masterclass is best suited for beginners who want to understand the basics of personal finance and early retirement planning.

Does the masterclass include any bonuses or extra material?

No additional bonuses are included with this masterclass. However, lifetime members of The 1% Club get access to extra resources and downloadable tools.

What is the language of the masterclass?

The Retire Early Masterclass is conducted in English.

Refund Policy of 1% Club Retire Early Masterclass

You will get a 7-day refund guarantee from the day of purchase, with certain conditions: (like finishing certain parts or showing proof)

For refund or any query, you can email support@onepercentclub.io

Refunds will not be issued if:

- The request is made after 7 days of purchase.

- You haven’t completed at least 50% of the course.

- You’ve violated any platform rules (such as sharing login credentials, copying, or reselling content).

- The platform reserves the right to refuse or cancel service without a refund in cases of misuse, illegal activity, or policy violations.

Final Verdict 🎯

- If you are looking for a paid online personal finance course, then you can choose this Sharan Hegde Masterclass.

- The masterclass covers the fundamentals of personal finance — managing income and expenses, building the right money mindset, understanding investments, retirement planning, insurance, and tax saving.

- However, it does not cover topics like emergency funds or debt management in detail. Sharan mainly focuses on tracking expenses, understanding loan EMIs, setting a retirement age, and calculating your retirement corpus.

- So, this masterclass is best suited for beginners who want to get clarity and structure around money management.

- If you already have a good understanding of personal finance or want to go deeper, you might find it more of a refresher. In that case, you can explore his advanced finance programs or even check out Ankur Warikoo’s “Take Charge of Your Money” course (available in Hindi) or other options.

In short, the topics are foundational and helpful for starters, but evaluate your current financial knowledge before deciding to enroll.

Free alternatives of 1% Club Retire Early Masterclass

💡 Bonus Tips to Build Your Retirement Corpus

⚠️ Affiliate Disclosure

This post is not sponsored, and we are not using any affiliate links. All opinions expressed are entirely our own.

At CourseDekhlo, we always focus on delivering value, clarity, and trust to our readers.

💬Have you taken the Sharan Hegde Retire Early Masterclass? Share Your Feedback

✅ Drop your thoughts in the comments below — your experience could help thousands of other learners make smarter choices.

Let’s build a smarter learning community together.