Take Charge of Your Money Review- A Personal Finance Course That Starts With ‘Why’

In our home, we hear every time, “We don’t have money.” Every time, our parents argue only on this topic — we don’t have money. But why? 🤔 Can you imagine? Our parents are also saving, but why don’t we have money? They earn, save, and spend wisely — but why?

Because anything without an objective has zero value.🎯

That’s where Ankur Warikoo’s “Take Charge of Your Money” course steps in.

He advertises his course and says this course will help you. This course gives you the answer to your “why?”

In this 👉honest review, we break down what the course offers, who it’s for, and whether it’s actually worth your time and money.

What Is ‘Take Charge of Your Money’ by Ankur Warikoo?

Brief overview of the course, platform, and its core goal:

“Take Charge of Your Money” is a personal finance course created by Ankur Warikoo and hosted on WebVeda.

In his ‘Take Charge of Your Money course, Ankur Warikoo talks about his life overview, his life mistakes, and his life learnings.

So in this course, Warikoo shares with you his personal experiences about his financial journey.

🗣️ This is an Ankur Warikoo line – he said,

“I have been educating people through my own learnings and experiences with money.”

📚 In the Take Charge of Your Money course, Ankur Warikoo talks about:

- What money is

- How to save and invest money

- Emergency funds

- Insurance

Platform: The website of Ankur Warikoo’s course is WebVeda.

- Core Purpose of the “Take Charge of Your Money” Course

Who is this course for?

- Students and fresh graduates who want to understand money before earning it.

- Young professionals looking to fix poor money habits without compromising their lifestyle.

- Anyone who wants to learn about personal finance.

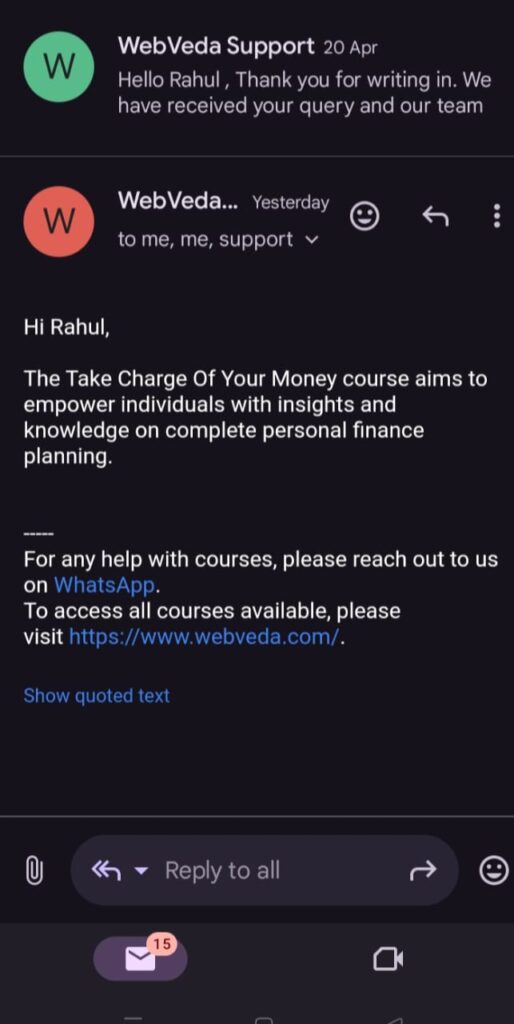

🛈 “In the Take Charge of Your Money course, there are no student discounts or special deals.“

About Ankur Warikoo: Why Learn Money from Him?

In this course🧑🏫, your teacher is Ankur Warikoo, with a background in entrepreneurship, content creation, and productivity coaching.

Ankur Warikoo mostly talks about personal finance on YouTube. He has also written some books and is running a WebVeda learning startup.

In this course, he shares with you his own financial mistakes, learnings, and overall achievements in his financial journey.

In the past, he also built several businesses like Nearbuy.com.

As Ankur Warikoo says, “Money won’t give you happiness, but it will for sure give you the freedom to fulfill your dreams.”

What You’ll Learn in the “Take Charge of Your Money” Course?

In this personal finance course, Ankur Warikoo teaches you:

✅What is money? How and when you can invest your money in different types of investment instruments like stocks, mutual funds, property, etc.

✅When to start investing, when to buy a home, how to use a credit card effectively, and how to build a healthier relationship with money.

✅Make extra income streams — maybe start a website like CourseDekhlo, create assets and reduce liabilities, set goals for saving, and ensure you have safety first with health and life insurance, and emergency funds.

✅How to pay your debt wisely.

✅Avoiding common money traps like credit card debt, lifestyle inflation, and poor financial decisions.

✅Individuals in their 30s: People who believe it’s too late to start financial planning. In this course, Warikoo shares some age- and income-based investment strategies.

FAQs

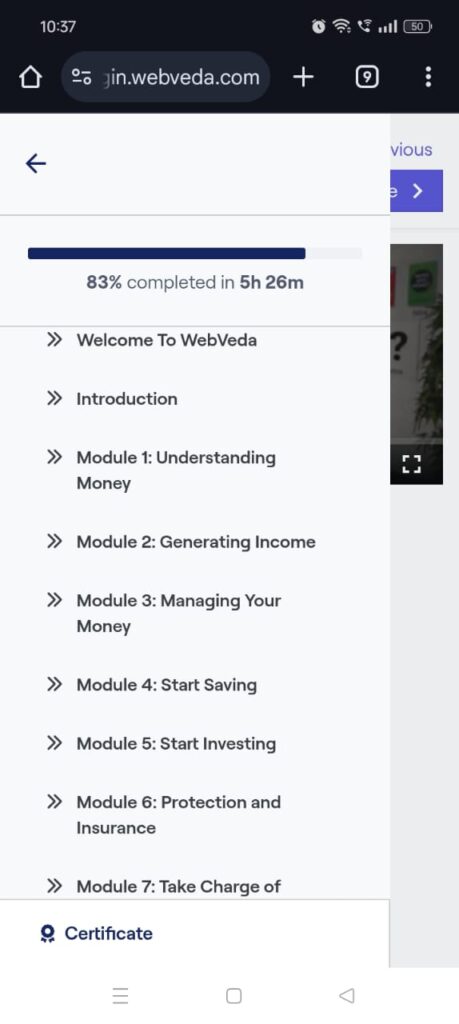

What modules does the course include?

Understanding of money, generating income, managing finances, saving and building wealth, Financial planning based on age and income, protecting your money (insurance, risk management)

In which language is this course available?

This course is available in two languages: English and Hindi, but the course material is in English.

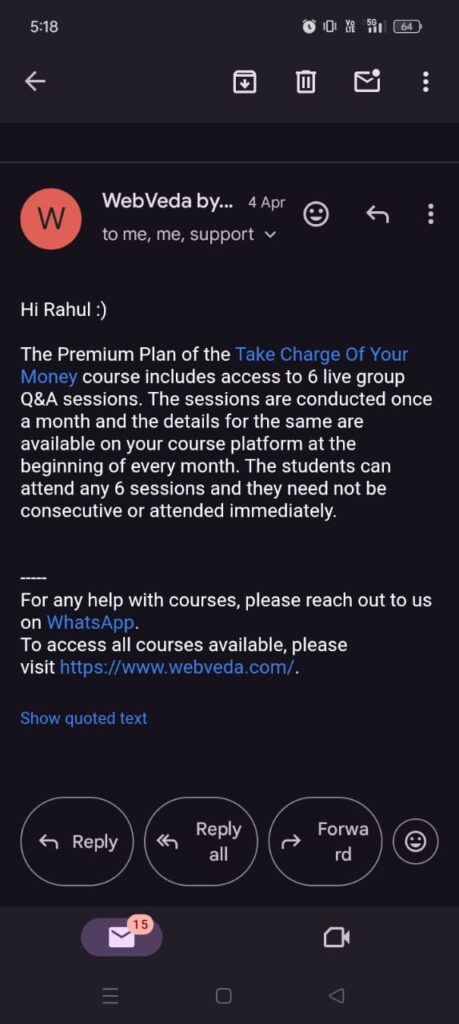

How can you contact them if you have any issues or concerns?

You can connect with them through their WhatsApp support or email them at support@webveda.com or webveda@ankurwarikoo.com.

Does this course come with a certificate of completion?

Yes, you will get a digitally signed certificate with your name after completing the course.

How can I clear my doubts during the course?

Only premium users of the course get 6 monthly live group Q&A sessions with Warikoo, and for that, you need to wait. You will receive session notifications from WebVeda.

If I cancel my course, will I get a refund?

Yes, you can cancel your course within 14 days from the date of purchase by contacting their WhatsApp support. You will get a refund without any questions.

What are the 8 steps in personal finance?

Fulfil your needs

Take protection with health & life insurance

Build an emergency fund

Create small savings for wants

Develop habits & goals for saving

Invest

Don’t buy anything just to show off

Use credit cards wisely

Are there any student discounts or special deals in the Take Charge of Your Money course?

No, the course does not offer any student discounts or special deals at the moment.

Feedback and Effectiveness of “Take Charge of Your Money Course”

🟢Pros

- This personal finance course is helpful if you are looking for a paid course.

- This course creates an understanding of your money because most of us struggle with financial planning, impulsive spending, or just don’t know where to begin.

- 📘 Real Insights

This course will give you ideas, information, the coach’s personal experience, and some strategies for financial planning. - You have two choices to learn personal finance from Ankur Warikoo:

🔹 You can choose this course

🔹 Or you can read his Make Epic Money book

🔴Cons

- 🧾 Too Basic for Some

In this money management course, Ankur Warikoo shares his personal experience of financial literacy; if you already know about investing, stocks, budgeting, security, or technical finance, this might feel too basic. - 🔓 Free Content Available?

Some say all learning modules are freely available. - ⏳ Limited Doubt Support

If you have a doubt, you need to wait for the monthly live Q&A sessions. - 🎥 Reused Content

Some videos are taken from his YouTube channel.

My Learning Experience

Everyone wants to control their money, everyone wants to increase their money every single minute, and for that, you need to earn and learn some simple or advanced techniques to grow🌱 money wisely.

For that reason, we 👀looked at this course because of Ankur. We thought we would learn some unique techniques to grow our money because we also want to earn lots of money and save.

But then we realized this is not a new thing. Humans have been saving🏦 money for many decades by using traditional methods. But just like our wants and goals change every time, our world is also changing, and for that, we need to stay up to date.

So in this rapidly advancing era🕒 we need to learn some modern techniques to save, invest, and grow our money, because nowadays we have lots of options to spend money, and for that, we need to learn from free or paid resources, so we chose a paid course.

There was nothing new in this course that I didn’t know before, but despite knowing it, my money habits were still 🤯poor.

But I definitely learned a few things from this course; just like we make our life goals, we should also know our saving 💡goals. Yes, this is nothing new, but maybe I had forgotten it, or I did not know about it.

So now it depends on you whether you should take this course or not, whether you really need it or not.🤔

I think, if I didn’t know about personal finance, I would decide to learn it from free or paid courses to manage my money wisely.

Final Conclusion

Now the questions in your mind❓

- Should you take Ankur Warikoo’s finance course?

- Will this course help you?

- Is this course right for you?

- Will this course suddenly change your life?

Then the answer is ✅

This course, or any course or free resource, gives you the roadmap and understanding of the process.

But after learning, you need to understand your income sources, your budget, your expenses, your family size, your needs and wants, see your pocket, and then apply your learning.

In any course, if you already know about the course topics through videos, books, etc., then no one can teach you any special, magical things in the course.

- In any course, first, you will get all course materials organized in proper modules.

- You will get some extra examples and some additional things, like tools to monitor your work and Q&A sessions.

- Personal experiences and tips from the coach.

“I think if you’re very young, around 20–25, you should focus on learning as much as possible, build income streams, and after that, gradually start investing.”

This is just my opinion — it may not apply to everyone.

As I always say, before starting anything, understand your own situation first.

Refund Policy You Should Know!

| Detail | Information |

|---|---|

| Refund Window | 14 days from the date of purchase |

| Applicable Courses | All courses and plans, including “Take Charge of Your Money” |

| Refund Reason | If you do not get any value from the course |

| How to Request a Refund | – WhatsApp Support – Email: 📧 webveda@ankurwarikoo.com / support@webveda.com |

| Confirmed By | WebVeda Team |

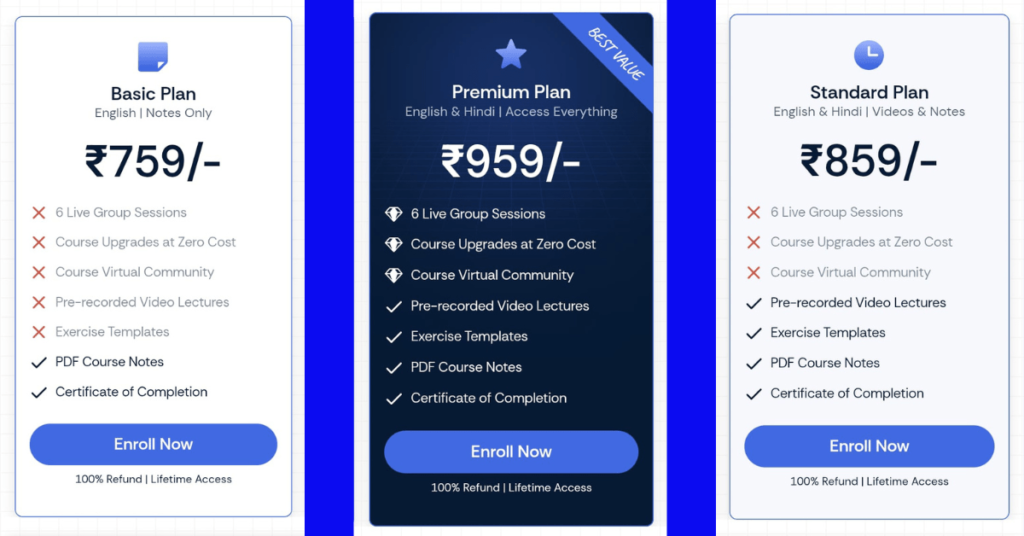

Course Payment Plans

Explore Free Resources

- These are some free videos and blogs to learn money management.

Free Course on Personal Finance

Bonus Tip

Don’t use free money management apps to calculate your day-to-day finances, because many of these apps sell your data to other companies.

As a result, you could end up in a spending trap — you think you’re tracking your money, but if a company knows your expenses, they’ll advertise products to you accordingly.

👉 So, the best option is to use Excel to track your money manually.

Affiliate Disclosure

Disclaimer: This post is not sponsored, and we are not using any affiliate links. All opinions expressed are entirely our own.

At CourseDekhlo, we always focus on delivering value, clarity, and trust to our readers.

Join the CourseDekhlo Community and be a part of the change in online courses. Share your valuable feedback!🤝

💬 Have you taken Ankur Warikoo’s “Take Charge of Your Money” course?

We’d love to hear from you! Share your thoughts, experiences, or even your biggest takeaway in the comments below.👇